Trusting a Trustee

7 February 2022

Feature Article by Alex Picot Trust

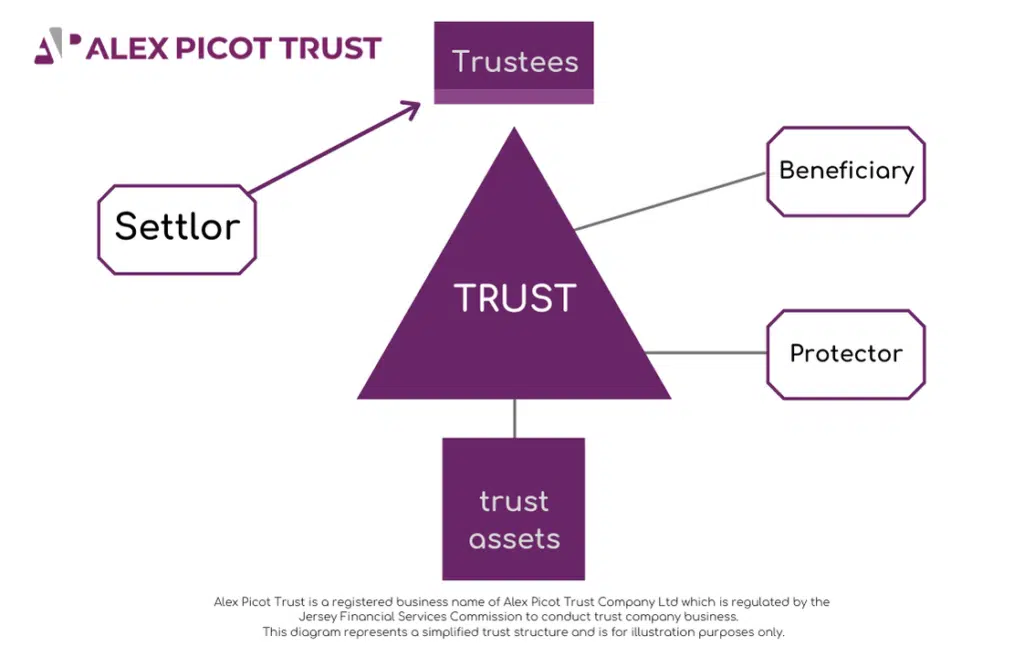

Establishing trusts has long been a popular wealth structuring tool for high-net-worth families. It involves giving away legal title, ownership and an element of control of family assets to a business based in an overseas jurisdiction.

A fundamental question for new clients is ‘Can I really trust a Trustee?’

Professional trust companies, operating in reputable and highly regulated jurisdictions have been providing fiduciary services to clients since the middle of the last century. While the reasons for the use of trusts may have evolved over time the role that professional trustees fulfil remains as current as ever.

This article explores why clients continue to be comfortable creating offshore family trusts.

Why do people use offshore trustees?

UK resident foreign domiciled individuals who have assets held overseas or people locating to the UK who have not yet arrived are able to have their surplus overseas wealth managed and controlled in specialist offshore finance centres.

Trusts can offer benefits in ensuring assets are held in a tax compliant manner for succession purposes, family governance reasons, to avoid future dilution or break up of family businesses or other cherished family assets.

Trustees can hold a wide range of assets from banking and traditional investment portfolios with quoted and unquoted holdings; real estate; family business assets; works of art; and moveables such as yachts and planes.

There continue to be tax advantages for the settlors and the beneficiaries of the trusts if the vehicles are structured correctly at the outset with professional legal and tax advice taken to ensure the arrangements are tailored for the needs of each individual family.

Oversight of the Trustee

Consider the offshore trust as a virtual overseas ‘warehouse’.

The ‘warehouse’ can hold a wide range of family assets and investments.

The settlor and beneficiaries of the trust have the rights to inspect the assets at any time and obtain full information on how they are being managed and looked after.

The Trustee has a written document (Trust Deed) which sets out the rules and regulations as to what powers sit with the Trustee and which regulate the actions the trustees are empowered to undertake. The trustees can only take assets out of the ‘warehouse’ if they are for the benefit of the persons listed in the Trust Deed as beneficiaries.

The trustees are also accountable to the beneficiaries to demonstrate that the investments have been professionally managed. These obligations, enshrined in Trust Law, ensure that professional trustees are required to adhere to the highest standards at all times.

Settlors provide further guidance to their trustees through Letters of Wishes (LoW).

While not legally binding (as if they were there would be a danger that the wide powers issued to the trustees under the terms of the Trust deed could be constrained) a LoW is a useful guiding document that settlors give to their trustees. It sets out their views on how the trust assets should be managed and their wishes on future distribution policies.

A LoW is particularly important once the settlor is no longer alive or able to communicate with the trustees. The LoW can be updated at any time and trustees regularly review the contents of these with the Settlor.

What role does a Protector play?

The Trust Deed can contain provisions for certain powers to sit with an independent third-party called a Protector.

In most instances these powers are limited to the hiring and firing of trustees, but can also be extended wider (subject to tax considerations around the jurisdiction of the Protector) to include protector consent being required for any changes to the beneficiaries, investment strategy or to consent to distributions above a certain threshold.

Having a trusted individual (perhaps a business associate or long-standing family advisor) act as Protector ensures that there remains an independent set of eyes and ears to look out for the beneficiaries and to step in and effect a change of trustee should the need ever arise. This is a further incentive to ensure that trustees live up to the promises around their service levels made to their clients at the outset of the relationship.

Additional Comfort – the right jurisdiction

Well-run and highly regulated International Financial Centres, such as Jersey, ensure that all businesses that provide trustee services to third parties must be properly licenced and are then routinely supervised by their regulator. Key personnel in the business are individually assessed as being appropriate to manage the business.

All employees are required to act with due skill, care and diligence when fulfilling their role and to act in the best interests of the client at all times.

Family Engagement

Trustees are required to keep full books and records of the structures that they administer.

Face-to-face meetings between trustees and their clients are actively encouraged and regular review meetings with the participation of the legal / tax / investment advisors are an important way of ensuring that the structure remains up to date and continues to fulfil the purpose for which it was established. This also ensures trustees are aware of any changes in family circumstances.

Summary

Offshore trusts continue to play an important and relevant part of the overall design of an international family’s estate and wealth structuring arrangements.

While the notion of parting with valuable family assets to an unfamiliar company in an overseas jurisdiction may seem alien at first, as can be seen, there are a number of ways of providing the assurance new clients seek when establishing a family trust.

Each family’s circumstances are different and the solution that works for them will be determined with bespoke arrangements tailored to suit their requirements.

Written by Steve Gully and Hannah Roynon-Jones

About the authors

Steve Gully and Hannah Roynon-Jones, Directors at Alex Picot Trust

Alex Picot Trust is a management owned, private client focused independent trust company based in Jersey and has been providing fiduciary services to private families since 1932.

Alex Picot Trust is a registered business name of Alex Picot Trust Company Ltd which is regulated by the Jersey Financial Services Commission to conduct trust company business.

Additional Offshore Trust Blogs, News & Resources

-

2024 Autumn Budget – Inheritance Tax

Reading Time: 2 minutesSummary of Changes for IHT; Individuals and Offshore trusts The current non-domicile tax regime, including the remittance basis of taxation, will be abolished from 6 April 2025. It will be replaced by a new “residence based” approach. This note focuses on how the changes affect inheritance tax (“IHT”). Separate notes consider the…

-

2024 Autumn Budget – Offshore Trusts

Reading Time: 2 minutesSummary of Changes for Offshore Trusts The current non-domicile tax regime, including the remittance basis of taxation, will be abolished from 6 April 2025. It will be replaced by a new “residence based” approach. This note focuses on how the changes affect offshore trusts. Separate notes consider the impact on income tax…

-

Transatlantic Trust Issues and UK vs US Trusts

Reading Time: 5 minutesComplications that can arise in UK/US trusts A family trust remains a popular vehicle to allow for the passing of wealth to the next generation. This is because it can provide flexibility, discretion and an element of control which is attractive to many. For US citizens, US trusts are often discussed in…

-

Inheritance Tax for Settlor Interested Offshore Trusts

Reading Time: 4 minutesInheritance tax for settlor interested offshore trusts In the previous part of our series on offshore trusts we considered the UK capital gains tax treatment of beneficiary-taxed offshore trusts. In this sixth part of our series we consider the inheritance tax (IHT) treatment of settlor interested offshore trusts This is part 6…

-

Capital Gains Tax on Beneficiary-Taxed Offshore Trusts

Reading Time: 4 minutesOffshore Trusts Series In the previous part in our series on offshore trusts we considered the UK income tax treatment of beneficiary-taxed offshore trusts. In this fifth part of our series we consider the capital gains tax treatment of beneficiary-taxed offshore trusts. This is part 5 of our Offshore Trusts blog series,…

-

Beneficiary-Taxed Offshore Trusts

Reading Time: 3 minutesIncome Tax In the previous part in our Offshore Trusts series we considered the UK income tax and capital gains tax treatment of settlor-interested offshore trusts. In this fourth part of our series we consider the income tax treatment of non-settlor interested, or beneficiary-taxed, offshore trusts. This is part 4 of our…

-

Settlor-Interested Offshore Trusts

Reading Time: 5 minutesSettlor-taxed non-UK resident trusts – income tax and capital gains tax In the last part in our series on offshore trusts we considered rules for establishing trust residence. Once it is established that a trust is non-UK resident, our thought turns to how it will be taxed in the UK. A key…

-

Trusting a Trustee

Reading Time: 5 minutesFeature Article by Alex Picot Trust Establishing trusts has long been a popular wealth structuring tool for high-net-worth families. It involves giving away legal title, ownership and an element of control of family assets to a business based in an overseas jurisdiction. A fundamental question for new clients is ‘Can I really…

-

Residence Positions and Offshore Trusts

Reading Time: 3 minutesBefore considering the UK tax position for an offshore trust, it is important to first determine that the trust – is in fact – offshore….

-

What are Offshore Trusts and How Do Offshore Trusts work?

Reading Time: 3 minutesIntroduction and background to Offshore Trusts Something we are frequently asked by clients is ‘what are the consequences of being a…

News

For updates featuring tax changes, reminders for deadlines, pointers on how to maximise your accounts, and information on Everfair Tax and their activities: you need look no further than our news & resources pages.

View MoreContact Us

Need some UK, US or International advice?

Contact us now.

Weybridge Office

Ground Floor, 37a Church Street

Weybridge, Surrey KT13 8DG

Tel: 01932 320 800

London Office

40 Gracechurch Street,

London, EC3V 0BT

Tel: 020 3949 5999

Email: info@everfairtax.co.uk